(Disclaimer: This article is going to assume that you have a level of income sufficient to meet your needs with some wiggle room to spare. In other words, you have discretionary income and you could possibly spend more wisely or differently than you do today. If you are living at the poverty line while working multiple jobs I’m sorry but this is probably not the article for you. With this disclaimer in mind I hope to avoid the usual torrent of angry messages about how privileged and entitled I am.)

I used to live in a big house with a giant back yard. I had foxes, deer, ducks, voles, squirrels and who knows what else doing their thing in that yard. As a result, I never noticed a lot of the little activities that went on out there. Now, in South Philly, my “back yard” is a wooden patio deck with a single potted plant on it. In a surprise to no one when you strip away all the distractions and focus on one thing you notice more about that one thing.

And I just noticed that a goddamn squirrel was digging holes to hide nuts in the dirt of my plant.

The very same day I got a letter from my Health Savings Account (HSA) provider which reminded me to login to my account to check in on it.

Lo and behold I had a not insignificant pot of money that had accumulated that I had completely forgotten about.

In case you’re not familiar with HSAs they can be used as a tax-advantaged, meaning you don’t pay taxes on the money you put into them, savings account for either medical expenses (including elective ones, so if I ever decide to get Lasik I can use that money) or in a lesser-known strategy you can simply use it as an additional retirement account. The point of this article isn’t to explain HSAs in detail, however.

The point is that you can take advantage of some of the ways we are all irrational and driven by habits and whims rather than good sense when it comes to money.

You know that friend whose cheapness is exceeded only by their ability to accurately and pedantically account for exactly what portion of the check they owe, down to the penny?

Yeah that friend is the outlier. The exception to the rule. That friend probably already has a retirement account so teeming with money that they could afford to not be so cheap. I’m happy for them, but it’s probably not you.

Most people not only aren’t saving enough for later in life, but they’re actually going into debt far beyond their means. Everyone thinks that they’re going to save or invest money “when they have some extra” but no one ever has any extra because that’s not how most people operate with money.

For example, the average U.S. household carries $15,000 in credit card debt alone.

Imagine if I were to ask you if you’d like to take out a loan for $15,000. More than likely you’d decline, knowing that’s a sizeable chunk of money and not going to be easy to pay off.

Yet the psychological ease of handing over your credit card makes it all too easy to rack up the exact same amount of debt one small charge at a time.

It’s death by a thousand paper cuts. We’re not logical and rational, so we have to temper ourselves against… ourselves.

But the good news is that you can easily flip the script and take advantage of the same irrationalities to make your assets, instead of debts, inflate.

And it’s all totally automatic.

The vast majority of people operate the same flawed way when it comes to money. If they have money in their accounts they spend it, and if they don’t have money they cut back on spending. This might work fine when you’re a child with a piggy bank, but it falls apart when you have multiple credit cards, checking accounts, and auto-payments setup to take money out of your accounts. By the same token, all of these moving parts is what makes this “trick” work so well.

The key is to setup automatic transfers of money into investment or savings accounts, so you never see the money, you never miss it, and you cut back on spending because it’s not there.

There are dozens of ways to do this, but I’ll give you a couple examples of the simplest things you can do.

The absolute first thing you should do money-wise is take advantage of an employer-matched retirement program if your job provides one. This is LITERALLY free money and you would be crazy not to take advantage of it. Whatever it is, a 401k or an IRA, take advantage of it up to the maximum contribution. It’s also…wait for it… automatic. Every company should opt you in automatically by default, but many (most?) don’t.

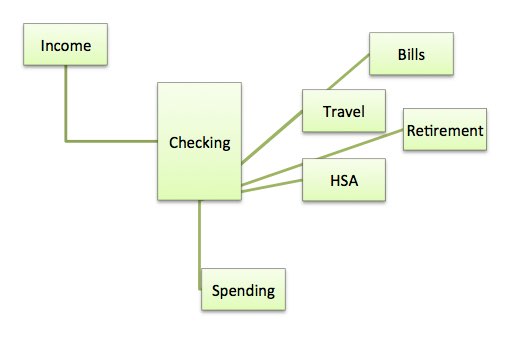

With that out of the way, it’s time to setup some automatic transfers into other savings vehicles.

As an example, I have money automatically transferred out of my checking account into 4 separate buckets:

- Bills – all major bills are on auto-draft so I don’t have to remember to pay them, and I never see that money.

- Travel – Jen and I each contribute $200/mo to this, so at least once a year there is enough money for a pretty significant trip that is completely paid for and we don’t have to find the money for.

- Retirement – this consists of several different buckets of different investment vehicles. What is best for you is very much going to depend on your situation, but the important thing is that you have something. If in doubt start by maxing out an IRA and then go from there. Do your own homework and get some expert advice, but I use Betterment for a non-trivial portion of my net worth and couldn’t be happier. For the reasoning, check out this Planet Money episode. Betterment is just a very easy way to automatically invest in index funds.

- HSA – this is both a health rainy day fund as well as a backdoor retirement account.

I never see any of this money, and I never miss it. Everything happens with automatic transfers behind the scenes. Of course my spending habits have had to shift with a not-insignificant portion of my income being hidden away from me, but the point is that I don’t notice it.

I never see any of this money, and I never miss it. Everything happens with automatic transfers behind the scenes. Of course my spending habits have had to shift with a not-insignificant portion of my income being hidden away from me, but the point is that I don’t notice it.

You spend it if you have it, but you don’t spend it if you don’t have it.

Actual Real Steps to Take

Basically, open a Betterment account. People who talk to me about money eventually wonder why I am such an evangelist for Betterment (Wealthfront is good too. Charles Schwab’s product is not.)

There are some really basic fundamental evidence-based truths about investing that have held up over time.

- Don’t lose money.

- Invest often and regularly.

- Allocate assets intelligently. (aka don’t put all your eggs in one basket)

- Don’t try to pick stocks. (See #1)

- Don’t time the market. (See #2)

- Avoid fees that eat up your returns.

Turns out so-called robo-advisors like Betterment and Wealthfront basically solve these problems for you. They make it easy to automate, they balance everything for you, they have ultra low fees, and they invest you in a wide range of low-cost ETFs that cover broad indices. You can still screw it up by being a stupid human and yanking your money out, but it’s harder!

I don’t care what you use. I’m purposely not including my Betterment referral link because I’ve already maxed out my referrals, but if you want the link to get the free 6 months reach out to me and I’ll send it to you.

But, please, do something.

If you don’t know if you should create a taxable account, a Roth IRA, or a traditional IRA I can give you one simple tip and a reference article. If you don’t have ANY safety net at all, create a normal taxable account so that there is no risk of penalty if you need to use the money in an emergency. If you have that covered you can decide between a Roth and traditional and this article is helpful for that.

What you actually do with the money you’re saving is important, but not as important as that you automate putting the money away.

I’m In Debt!

So all of this sounds great you say, but you’re in debt you say, so there’s no extra to invest nor would it be a good idea with the interest you’re paying on the debt. I’ve been there. Turns out the exact same principle still applies. Take a fixed amount and apply it automatically to your debt until it’s gone. When that is done immediately shift that same amount over to investments. You will be accustomed to a certain standard of living and that won’t change, but you’ll now be putting money away for the future.

How much to squirrel away?

The short answer is an amount that makes you uncomfortable, but not enough to put you in a bad position or cause problems.

As a longer answer here are a few strategies you can use to come up with an amount:

- Take your bank and or credit card statement from the previous couple months and go through them line by line. Add up all the charges that are discretionary. Restaurants, bars, Amazon orders, movies, new iPhones, and so on. Be ruthless and honest in this. If you didn’t have to spend it to keep a roof over your head or food in your belly, add it up. Take the whole amount and divide it by the number of months you looked at, and then take 20% of that amount. If you spent $1000 on discretionary things, you’d come up with $200. Start there. Every six months increase the amount by 10%.

- Just start with $100. Every three to six months increase it by $100 until it causes too much strain, then back off.

- The nuclear option: Go to this calculator and put in your details Play with the “I save X amount annually” until you get to the number that balances what you are likely to have in retirement, and what you’ll need in retirement. Start putting that amount of money away and force everything else to fall into place.

No matter what you choose to do, the important thing as always is that you take action.

Don’t get lost in the weeds of the details of finance – really, it’s not that complicated. Take and implement the lesson of automation and only then start figuring out how you can optimize your various contributions and vehicles.

I have just looked into doing something like this, but my question is where do you have your sub-accounts (travel, bills, etc). I looked into opening separate checking accounts, but they all have minimal balances so it didn’t seem worth it.

There are a few ways arounds this. Personally I don’t have any sub-accounts for checking. The bills are just autopaid out of my checking. I do have sub-accounts (Goals) in Betterment for Travel/Retirement/Emergency/etc.

It really depends on your bank what the best way to do this is. Some banks will waive the fees and min balanace if you auto-transfer $50 or $100 every month into the account, but you can transfer it right back out. Otherwise look into online options like CapitalOne or HSBC. I have a Simple.com account that I use to keep some things separate. Where there’s a will there’s a way.

Great philosophy on life and in health. Something that has stuck with me is FOCUS – Follow One Course Until Success. That course to me can be anything we make it. We must hold ourselves accountable to give our honest effort to stick with something long enough to reap the maximum benefits. If we look for distractions, we will find them. Great article!